Financial Analysis That Actually Makes Sense

Stop guessing about your business decisions. Our training programs teach you to read financial data the way experienced analysts do—with confidence and clarity.

See How We TeachAnalysis Without the Jargon

Most financial training assumes you already speak the language. We start from where you actually are—running a business and needing to understand what your numbers really mean.

Our approach breaks down cash flow statements, balance sheets, and profit margins into something you can work with. Not simplified versions. The real thing.

We focus on interpretation over calculation. Modern software handles the math. Your competitive edge comes from knowing what those numbers are telling you about your business.

How You'll Actually Learn This

Our October 2025 cohort follows a structured path that builds from basic financial literacy to sophisticated analysis techniques.

Financial Statement Fundamentals

You'll learn to read the three core financial statements without getting lost in accounting terminology. We cover what matters for decision-making, not exam preparation.

6 weeks • Self-paced with weekly check-ins

Ratio Analysis and Performance Indicators

Calculate and interpret the metrics that reveal business health. Liquidity ratios, profitability margins, efficiency indicators—you'll know what each one actually tells you.

5 weeks • Applied case studies

Cash Flow and Working Capital

Understand where money moves in your business and why profitable companies sometimes can't pay bills. This phase focuses on the operational side of financial management.

4 weeks • Real business scenarios

Forecasting and Decision Modeling

Build realistic financial projections and evaluate investment opportunities. You'll work with sensitivity analysis and scenario planning to support actual business decisions.

6 weeks • Capstone project included

Who Teaches These Programs

Our instructors have spent years analyzing financial data for businesses across different industries. They know what works in practice, not just in theory.

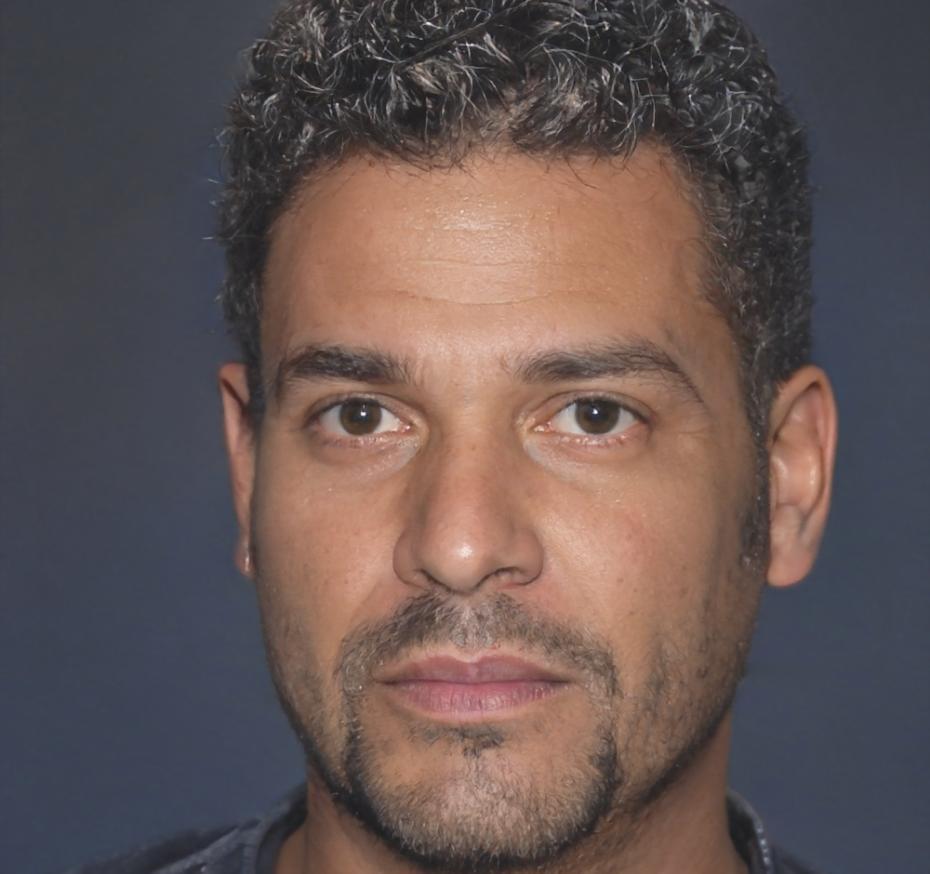

Crispin Aldworth

Lead Instructor, Financial Analysis

Spent twelve years as a management accountant before transitioning to education. Crispin focuses on teaching financial analysis techniques that actually get used after the training ends.

Tavish Bromley

Senior Instructor, Business Finance

Former CFO of a mid-sized manufacturing company. Tavish brings operational finance experience to the classroom, emphasizing practical application over theoretical frameworks.

Building Your Decision Framework

Financial analysis isn't about memorizing formulas. It's about developing a systematic way to evaluate options when you're facing real business decisions.

By the end of our program, you'll have a personal framework for:

- Evaluating capital investment opportunities with realistic risk assessment

- Identifying early warning signs in your financial statements

- Comparing your performance against industry benchmarks that matter

- Making pricing decisions based on actual cost structures and margin analysis

What You'll Work With

Our training uses real financial data from Australian businesses. You'll analyze actual statements, not simplified textbook examples.

Comprehensive Statements

Work through complete financial statements from manufacturing, retail, and service businesses to see how different industries structure their finances.

Forecasting Models

Build projection models that account for seasonal variation, growth assumptions, and changing market conditions using spreadsheet tools you already have.

Structured Timeline

Our autumn 2025 program runs for 21 weeks with clear milestones. Expect to invest 8-10 hours weekly for meaningful skill development.

Ready to Understand Your Numbers?

Our next cohort begins in October 2025. Enrollment opens in July with limited spaces available for the program.